0%

HDB Financial Services

HDB Financial Services

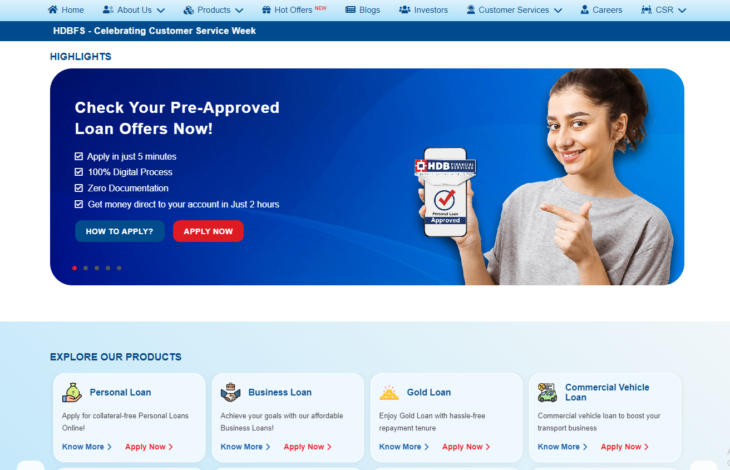

HDB Financial Services Limited is a leading non-banking financial company (NBFC) in India, offering a comprehensive range of financial products and services. Established in 1985, the company is headquartered in Ahmedabad, Gujarat, and has a strong presence across India through its network of branches and touchpoints. HDB Financial Services caters to both retail and corporate customers, providing services such as home loans, personal loans, business loans, vehicle loans, and gold loans. The company prides itself on its commitment to customer satisfaction, offering personalized solutions and transparent financial advice. HDB Financial Services utilizes technology to enhance customer experience and streamline processes. It has a strong focus on financial inclusion, reaching out to underserved segments of society through its innovative products and outreach programs. The company actively engages in social initiatives, contributing to the betterment of the community through various CSR projects. With its strong financial performance, robust risk management practices, and dedicated team, HDB Financial Services continues to be a trusted and reliable financial partner for its customers.

I went to take a personal loan through my friend’s referral. However, even though they initially lied about the loan interest of 18%, Which was fixed during the initial conversation. Then without the customer’s acceptance, they generated the document with the interest rate of 25% which doesn’t come under the RBI rules and this rule will also be applicable to the NBSC, and they didn’t even ask for the customer’s opinion about the interest rate. This is illegal! Don’t go and fall into this trap. They also moving with the central government scheme but still they’re asking for property documents as proof. Don’t waste your time by getting loan from this kind of fraudster.

I went to take a personal loan through my friend’s referral. However, even though they initially lied about the loan interest of 18%, Which was fixed during the initial conversation. Then without the customer’s acceptance, they generated the document with the interest rate of 25% which doesn’t come under the RBI rules and this rule will also be applicable to the NBSC, and they didn’t even ask for the customer’s opinion about the interest rate. This is illegal! Don’t go and fall into this trap. They also moving with the central government scheme but still they’re asking for property documents as proof. Don’t waste your time by getting loan from this kind of fraudster.